How one innovative platform is helping thousands of pizza franchise owners streamline their invoice processing, tax management, and financial operations while saving countless hours every month

Running a pizza franchise in today’s competitive market isn’t just about making great pizza—it’s about mastering the complex world of multi-location accounting that can make or break your business. Whether you’re managing two Domino’s locations in suburban Chicago or overseeing thirty Papa John’s stores across the Southwest, the financial challenges you face are unlike anything traditional bookkeeping software was designed to handle.

I’ve spent the last decade talking to pizza franchise owners across America, from small family operations in rural Texas to large multi-brand enterprises in bustling metropolitan areas. The story is always the same: traditional accounting solutions leave them drowning in paperwork, struggling with invoice management, and spending sleepless nights worrying about tax compliance and franchisor reporting requirements. These traditional bookkeeping systems rely heavily on paper-based forms and documentation, making the process even more cumbersome.

That’s exactly why QuickQore was born—and why it’s quickly becoming the go-to solution for pizza franchise owners who are tired of wrestling with outdated systems that weren’t built for their unique needs. Outdated systems often depend on paper forms and manual processes, which slow down financial operations and increase the risk of errors.

The Hidden Financial Complexity Behind America’s Favorite Food

Let me paint you a picture of what a typical Tuesday looks like for Maria Rodriguez, who owns four Pizza Hut locations in Phoenix, Arizona. Before discovering QuickQore, her day would start at 5 AM, not making dough or prepping toppings, but hunched over spreadsheets trying to reconcile the previous day’s sales across four different company files.

Each location generates dozens of receipts daily—from food deliveries and supply purchases to utility bills and maintenance expenses. Every invoice needs to be coded correctly, every discount properly recorded, and every transaction allocated to the right location’s books. Reconciling line items across receipts, invoices, and purchase orders is a tedious and error-prone process, making manual matching a significant challenge. Then there’s the constant juggling act of managing accounts receivable from corporate catering clients and accounts payable to dozens of vendors who supply everything from cheese to cleaning supplies, with careful attention to the goods and services listed on invoices and purchase orders to ensure accuracy and transparency.

This isn’t unique to Maria’s situation. Pizza franchises across America are dealing with:

High-volume, low-margin transactions that require precise tracking

Multiple legal entities with separate tax obligations

Complex vendor relationships spanning food suppliers, equipment leasing, and service providers

Stringent franchisor reporting requirements that demand specific formatting and timing

Seasonal fluctuations that affect everything from labor costs to ingredient pricing

Multi-state operations with varying tax codes and compliance requirements

Traditional bookkeeping solutions simply weren’t designed for this level of complexity. They’re built for single-location businesses with straightforward accounting needs, not the intricate web of financial relationships that define modern pizza franchise operations.

Why Generic Accounting Software Fails Pizza Franchises

Here’s the uncomfortable truth that most software companies don’t want to admit: generic accounting platforms are actually costing pizza franchise owners thousands of dollars and hundreds of hours every month.

Take the seemingly simple task of processing daily sales. With traditional software, you’re looking at:

Manual data entry across multiple company files and forms – logging into each location’s separate accounting system, recording transactions in various forms such as journals or daybooks

Repetitive invoice processing – entering the same vendor information multiple times

Time-consuming reconciliation – matching receipts to bank deposits across multiple accounts

Transferring data between systems – ensuring that financial information is accurately transferred from one ledger or file to another

Complex tax calculations – managing different tax rates and jurisdictions

Inconsistent reporting formats – reformatting financial statements to meet franchisor requirements

Disconnected accounts receivable and payable tracking – managing customer payments and vendor obligations separately

The result? What should take minutes stretches into hours, and what should be automated becomes a manual nightmare that’s prone to costly errors.

I spoke with James Thompson, who owns eight Little Caesars locations across Ohio and West Virginia. Before switching to QuickQore, he was spending 15-20 hours per week just on basic bookkeeping tasks. “I was essentially running a part-time accounting firm on top of my pizza business,” he told me. “Every invoice, every receipt, every bill had to be entered manually across eight different company files. It was insane.”

Enter QuickQore: Purpose-Built for Pizza Franchise Success

QuickQore didn’t emerge from a boardroom brainstorming session about “disrupting accounting.” It was born from real conversations with real pizza franchise owners who were frustrated with the limitations of existing solutions.

The development team spent two years embedded with franchise operators, understanding their daily workflows, their pain points, and their unique requirements. They watched managers struggle with invoice processing at 6 AM. They observed the month-end chaos as owners scrambled to compile tax documents and franchisor reports. They witnessed the inefficiencies that were bleeding time and money from otherwise successful operations.

What emerged is a platform that speaks the language of pizza franchise operations—a system that understands the difference between managing accounts payable for a food supplier versus a cleaning service. This process involves multiple steps, including invoice verification and approval, to ensure accuracy and efficiency. The platform also knows how to handle discounts and promotions in a way that satisfies both your P&L and your franchisor’s requirements, while emphasizing the importance of internal controls to prevent errors and ensure regulatory compliance.

Revolutionary One-Click Multi-Store Operations

The flagship feature that sets QuickQore apart is its revolutionary one-click multi-store functionality. Instead of the traditional nightmare of managing separate company files for each location, QuickQore allows you to upload a single consolidated sales file and automatically distributes the data to each store’s individual accounting records. In addition, all relevant financial data is automatically transferred to the appropriate accounts for each store.

This isn’t just a time-saver—it’s a game-changer. What used to take hours of manual bookkeeping across multiple systems now happens in minutes with perfect accuracy. Invoices are automatically allocated to the correct locations, tax calculations are handled seamlessly across different jurisdictions, and your accounts receivable and accounts payable remain perfectly synchronized across your entire operation.

Sarah Chen, who manages twelve Marco’s Pizza locations across California, describes the transformation: “The first time I used the one-click upload feature, I literally thought something was wrong. I uploaded our daily sales data and expected to spend the next two hours distributing everything manually. Instead, I was done in three minutes. I checked and double-checked the books—everything was perfect. It was like having a team of expert bookkeepers working at superhuman speed.”

Intelligent Invoice and Receipt Management

QuickQore’s approach to invoice and receipt management represents a fundamental shift in how pizza franchises handle their financial documents. The platform’s intelligent recognition system can automatically categorize and code expenses based on vendor patterns, typical purchase amounts, and historical data. Invoices often serve as formal payment requests from vendors, and QuickQore ensures these requests are processed efficiently.

When a receipt from your regular food supplier comes in, QuickQore doesn’t just record it—it analyzes it. It knows that your weekly produce order should be coded to food costs, that the equipment lease bill needs to be allocated across multiple locations based on square footage, and that the marketing invoice should be split between local advertising and co-op fund contributions.

The system also handles discounts and promotional expenses with sophisticated logic that ensures compliance with franchisor requirements. Whether you’re running a “Buy One, Get One Free” promotion that affects your cost accounting or managing volume discounts from suppliers, QuickQore tracks everything with precision that manual bookkeeping simply can’t match. Invoices are marked as paid once the payment is processed, helping you keep accurate records of settled accounts payable.

Streamlined Tax Management for Multi-State Operations

Tax compliance for multi-location pizza franchises is a minefield of complexity. Different states, different rates, different filing requirements, different deadlines—it’s enough to keep any business owner awake at night. Adhering to relevant tax laws and regulations is essential to ensure all payment transactions and filings meet legal requirements.

QuickQore brings clarity to this chaos with built-in tax management tools that understand the nuances of multi-state food service operations. The platform automatically calculates sales tax obligations for each location, tracks tax-exempt purchases, manages quarterly estimated payments, and generates the documentation you need for both state and federal filings.

But it goes beyond basic compliance. QuickQore’s****tax features include:

Automated sales tax calculation across multiple jurisdictions

Tax-exempt purchase tracking for qualifying ingredients and supplies

Quarterly estimated tax payment reminders with automatic calculations

Multi-state tax reporting with jurisdiction-specific formatting

Audit trail maintenance for all tax-related transactions, ensuring records are retained for tax purposes and to meet IRS requirements

Integration with popular tax preparation software for seamless filing

Mike Davidson, who operates Papa John’s locations in both Florida and Georgia, credits QuickQore with saving his business during a recent multi-state tax audit. “The auditors requested five years of records across both states. With our old system, that would have meant weeks of document gathering and reconstruction. With QuickQore, I generated every report they needed in about twenty minutes. The audit was completed in two days instead of two months.”

Advanced Accounts Receivable and Payable Management

Managing accounts receivable and accounts payable across multiple pizza franchise locations requires a level of sophistication that traditional bookkeeping software simply can’t provide. QuickQore treats these critical functions with the complexity they deserve.

For accounts receivable, the system handles everything from individual customer payments to large corporate catering contracts. It tracks payment terms, sends automated reminders, manages partial payments, and provides detailed aging reports that help you maintain healthy cash flow across all locations.

The accounts payable functionality is equally sophisticated. QuickQore manages vendor relationships across your entire franchise network, tracks payment terms and discounts, automates approval workflows, and ensures that you never miss early payment discounts or incur late fees that eat into your already thin margins. Each vendor liability is tracked in an accounts payable account, which typically carries a credit balance to reflect the amount owed. When a new invoice is received, a credit entry is made to the accounts payable account, increasing the liability; when payment is made, a debit entry reduces the liability accordingly. Purchases of equipment or inventory are recorded in an asset account, while routine expenses are posted to an expense account. The system also tracks all expenditures and their impact on your company’s assets and overall financial position. With these features, QuickQore can calculate total expenditures and outstanding liabilities, helping you manage cash flow more effectively.

Lisa Park, who owns six Domino’s locations in the Seattle area, explains the impact: “Before QuickQore, I was constantly worried about missing vendor payments or losing early payment discounts. Now, the system tracks everything automatically. I get alerts for upcoming payments, reminders about discount deadlines, and detailed reports that help me optimize our cash flow. Last month alone, we captured over $2,000 in early payment discounts that we would have missed with our old system.”

The Real-World Impact: Success Stories from Across America

The true measure of any bookkeeping software isn’t in its feature list—it’s in the real-world impact it has on the businesses that use it. QuickQore has transformed operations for pizza franchise owners across the country, and their stories tell the real story of what’s possible when you have the right tools.

For example, when a pizza franchise receives an invoice from a supplier, QuickQore allows the user to record the invoice, match it to the corresponding purchase order, and then mark the transaction as paid once the payment is processed. This streamlined accounts payable process helps ensure accuracy and saves valuable time for business owners.

The Rodriguez Family: From Chaos to Control

Maria Rodriguez, whom I mentioned earlier, now manages her four Phoenix Pizza Hut locations with a level of efficiency that seemed impossible just two years ago. Her morning routine has completely transformed—instead of spending hours on manual data entry, she starts each day with a comprehensive dashboard that shows her exactly how each location performed the previous day.

“The difference is night and day,” Maria explains. “Every invoice, every receipt, every bill is automatically categorized and allocated to the right location. My accounts payable are managed automatically, so I never miss vendor payments or early payment discounts. The tax calculations are handled seamlessly across all locations. What used to take me 20 hours a week now takes maybe 3 hours, and it’s far more accurate than anything I could do manually.”

The Rodriguez family has seen measurable improvements across every aspect of their accounting operations:

85% reduction in time spent on daily bookkeeping tasks

Zero missed vendor payments since implementing QuickQore

$4,200 annual savings from captured early payment discounts

Perfect franchisor compliance with automated reporting

Reduced accounting fees due to cleaner, more organized books

The Technical Excellence Behind QuickQore

While the user experience is designed for simplicity, the technical foundation of QuickQore represents sophisticated accounting software engineering specifically tailored for franchise operations.

Intelligent Automation That Thinks Like a Pizza Professional

QuickQore’s automation capabilities go far beyond simple data entry. The platform incorporates machine learning algorithms that understand the patterns and relationships specific to pizza franchise operations.

When processing invoices, the system doesn’t just read vendor names and amounts—it analyzes purchase patterns, seasonal variations, and location-specific needs to ensure accurate coding and allocation. It recognizes that a $500 invoice from your food supplier in December likely includes holiday promotion ingredients, while the same amount in July might be standard inventory replenishment.

The system’s receipt processing capabilities are equally sophisticated. QuickQore can extract relevant information from receipts captured via smartphone, automatically match them to pending invoices, and flag discrepancies for review. This level of automation reduces manual data entry by up to 90% while actually improving accuracy.

Integrated Tax Intelligence

QuickQore’s tax management capabilities represent years of development focused specifically on the complexities of multi-location food service operations. The platform maintains updated tax tables for all US jurisdictions, automatically applies location-specific rates, and handles the complex calculations required for food service businesses.

The system understands that pizza franchises deal with various tax scenarios that generic accounting software struggles with:

Varying sales tax rates on dine-in versus delivery orders

Tax-exempt status for certain ingredients and supplies

Multi-state nexus requirements for expanding operations

Local tax obligations that vary by municipality

Franchise tax calculations that differ from standard business taxes

Advanced Reporting and Analytics

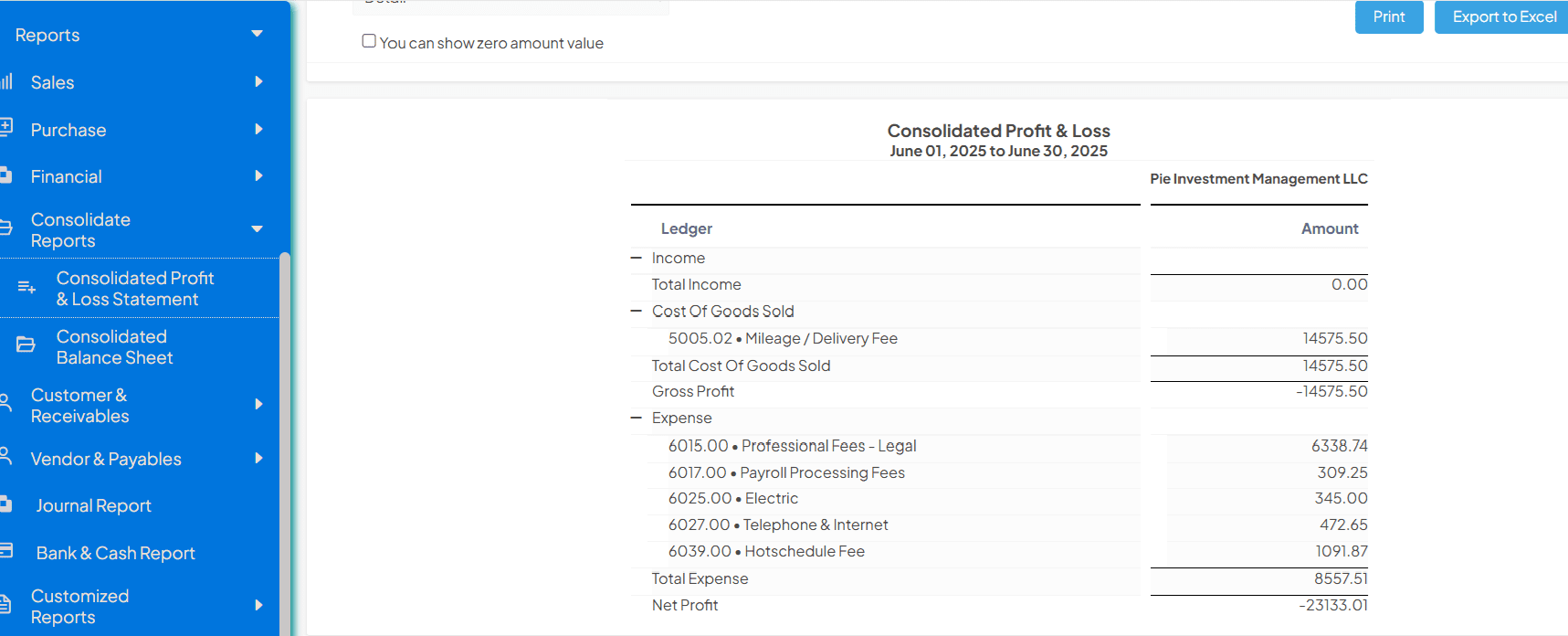

The reporting capabilities of QuickQore reflect a deep understanding of what pizza franchise owners need to know about their operations. Standard reports include franchisor-specific formatting, but the platform goes much deeper with analytics that help optimize operations.

QuickQore can analyze vendor performance, identifying suppliers who consistently deliver late or have quality issues that affect your bottom line. It tracks seasonal patterns in accounts receivable, helping you predict cash flow fluctuations and plan accordingly. The system monitors discount utilization across vendors, ensuring you capture every available savings opportunity.

Seamless Integration: Connecting Your Entire Operation

Modern pizza franchises rely on multiple software systems—POS terminals, inventory management, employee scheduling, and marketing platforms. QuickQore was designed from the ground up to integrate seamlessly with the tools you’re already using.

POS Integration That Actually Works

QuickQore’s integration with popular POS systems like Toast, Square, and others isn’t just about data transfer—it’s about creating a unified financial ecosystem. Sales data flows automatically from your POS to your accounting system, but the integration maintains the detail level you need for effective bookkeeping.

Individual receipts are preserved, discount applications are tracked accurately, and tax calculations remain consistent between systems. This level of integration eliminates the reconciliation nightmares that plague traditional accounting setups.

Vendor Portal Excellence

QuickQore’s vendor portal functionality transforms how you manage accounts payable relationships. Vendors can submit invoices directly through the portal, track payment status, and access payment history without requiring phone calls or emails.

This streamlined approach reduces processing time for bills and invoices while improving vendor relationships. Suppliers appreciate the transparency and efficiency, often translating into better terms and discount opportunities for your business.

Banking Integration for Real-Time Reconciliation

QuickQore connects directly with major banking institutions to provide real-time transaction data. This connection enables automatic reconciliation of receipts and deposits, immediate identification of discrepancies, and up-to-the-minute cash flow visibility across all locations.

The banking integration also supports automated accounts payable processing, allowing you to schedule payments, capture early payment discounts, and maintain detailed audit trails for all financial transactions.

Compliance and Security: Protection You Can Trust

Pizza franchise operations handle sensitive financial data, customer information, and proprietary business intelligence. QuickQore takes security seriously with enterprise-grade protection that exceeds industry standards.

Bank-Level Security Standards

QuickQore employs the same security protocols used by major financial institutions, including:

256-bit SSL encryption for all data transmission

Multi-factor authentication for user access

Regular security audits by third-party experts

SSAE 18 compliant data centers with 24/7 monitoring

Automated backup systems with geographic redundancy

Role-based access controls for employee permissions

Compliance Automation

Beyond security, QuickQore helps ensure compliance with various regulatory requirements that affect pizza franchises:

PCI DSS compliance for payment card data

GDPR compliance for customer data protection

SOX compliance for publicly traded franchisors

State and local business licensing requirements

Food service regulatory compliance reporting

Audit Trail Excellence

Every transaction in QuickQore maintains a complete audit trail, documenting who made changes, when they were made, and what the previous values were. This level of documentation is invaluable during tax audits, franchisor reviews, or internal investigations.

The audit trail extends to all financial documents—invoices, receipts, bills, payments, and adjustments all maintain detailed history that can be accessed and reported as needed.

The QuickQore Advantage: Why Pizza Franchises Are Making the Switch

As I’ve traveled across the country speaking with pizza franchise owners, I’ve seen how organizations of all sizes benefit from improved internal controls and streamlined accounts payable processes. The decision to switch to QuickQore consistently comes down to three fundamental advantages that traditional accounting software simply cannot match, especially in supporting the organization and management of complex franchise operations.

Time Recovery That Transforms Operations

The time savings delivered by QuickQore aren’t just about efficiency—they’re about transformation. When you’re no longer spending 15-20 hours per week on manual bookkeeping tasks, you can focus on what actually grows your business: customer service, employee development, operational optimization, and strategic expansion.

Marcus Williams, who operates five Papa John’s locations in North Carolina, puts it best: “QuickQore gave me my life back. I was spending so much time on accounting that I barely had time to visit my stores. Now I spend my days working with customers, training staff, and planning new locations. The bookkeeping happens automatically in the background.”

Accuracy That Protects Your Business

Manual accounting processes are inherently prone to errors, and in the thin-margin world of pizza franchises, small mistakes can have big consequences. A miscoded invoice can throw off your cost analysis. A missed discount can cost hundreds of dollars. An error in tax calculations can trigger audits and penalties.

QuickQore’s automated systems eliminate the human error factor while actually improving accuracy through intelligent validation and cross-checking. The platform catches inconsistencies, flags unusual transactions, and ensures that your accounts receivable and accounts payable always balance perfectly.

Scalability That Supports Growth

Perhaps most importantly, QuickQore removes the accounting complexity that traditionally limits franchise expansion. When your bookkeeping system can seamlessly handle two locations or twenty, growth becomes a matter of opportunity rather than operational capacity.

The platform’s architecture is designed to scale effortlessly. Adding new locations doesn’t require new software licenses, additional training, or exponentially increased complexity. Your accounting processes remain consistent and manageable regardless of the size of your operation.

Implementation: Your Path to Financial Freedom

Switching accounting systems can feel daunting, especially when you’re managing multiple locations with complex financial relationships. QuickQore has perfected the implementation process to minimize disruption while maximizing the speed to value.

Dedicated Implementation Support

Every QuickQore implementation begins with a dedicated specialist who understands both the technical aspects of the platform and the operational realities of pizza franchise management. This isn’t a generic software installation—it’s a customized deployment designed specifically for your business model.

Your implementation specialist will:

Analyze your current accounting processes and identify optimization opportunities

Import historical data from your existing systems

Configure location-specific settings for each of your stores

Set up vendor relationships and accounts payable workflows

Customize reporting formats to match franchisor requirements

Train your team on all platform features and capabilities

Provide ongoing support during the transition period

Data Migration Excellence

QuickQore’s data migration capabilities are particularly sophisticated, handling the complex relationships between locations, vendors, customers, and financial accounts that characterize pizza franchise operations.

The migration process preserves:

Complete transaction history with proper location allocation

Vendor relationships including payment terms and discount agreements

Customer data with accounts receivable aging information

Tax records with jurisdiction-specific details

Historical reporting for trend analysis and comparison

Audit trails for compliance and regulatory requirements

Training That Ensures Success

QuickQore’s training programs are designed for busy franchise owners and their teams. The platform’s intuitive interface minimizes the learning curve, but comprehensive training ensures you’re getting maximum value from day one.

Training includes:

Live, interactive sessions tailored to your specific operation

Video tutorials covering all platform features

Written documentation for reference and troubleshooting

Hands-on practice with your actual data and workflows

Ongoing support as questions arise during daily use

Advanced feature training as your familiarity with the platform grows

Pricing That Makes Sense for Your Business

QuickQore’s pricing model reflects a fundamental understanding of how pizza franchises operate. Instead of charging per company file or per user like traditional accounting software, QuickQore offers transparent, scalable pricing that grows with your business.

Visit the pricing page for information in details.

No Hidden Fees or Surprise Charges

Traditional accounting software often hits growing businesses with unexpected costs – additional user fees, premium feature charges, or per-company file pricing that can quickly become prohibitive. QuickQore’s pricing is straightforward and predictable, allowing you to budget accurately and scale confidently.

The platform includes all core features—invoice processing, receipt management, accounts receivable and accounts payable, tax calculations, and reporting—without additional fees or feature restrictions.

Volume Discounts for Growing Operations

As your franchise network expands, QuickQore’s pricing actually becomes more favorable. Volume discounts reflect the platform’s efficiency gains and your growing commitment to the system.

ROI That Speaks for Itself

Most QuickQore customers report positive ROI within the first month of implementation. The combination of time savings, improved accuracy, captured discounts, and reduced accounting fees typically exceeds the platform cost by a significant margin.

Jennifer Martinez, who manages four Little Caesars locations in Texas, calculated her first-year savings: “Between the time I’m saving, the early payment discounts we’re now capturing, and the reduction in our accounting fees, QuickQore is saving us over $18,000 per year. That’s real money that goes directly to our bottom line.”

The Future of Pizza Franchise Accounting

QuickQore isn’t just solving today’s accounting challenges—it’s building the foundation for the future of pizza franchise financial management. The platform’s development roadmap includes exciting innovations that will further streamline operations and provide even deeper insights into business performance.

Artificial Intelligence and Predictive Analytics

QuickQore’s AI capabilities are constantly evolving, learning from the patterns and relationships specific to your operation. Future enhancements will include:

Predictive cash flow modeling based on seasonal patterns and growth trends

Automated vendor performance analysis with recommendations for optimization

Intelligent fraud detection to protect against accounting irregularities

Predictive maintenance scheduling based on equipment invoice patterns

Dynamic pricing recommendations based on cost analysis and market conditions

Enhanced Integration Capabilities

The platform’s integration ecosystem continues to expand, with planned connections to:

Advanced inventory management systems for real-time cost tracking

Employee scheduling platforms for integrated labor cost analysis

Marketing automation tools for comprehensive campaign ROI analysis

Equipment monitoring systems for predictive maintenance and cost optimization

Customer relationship management platforms for enhanced accounts receivable management

Mobile-First Enhancements

Recognizing that pizza franchise owners are constantly on the move, QuickQore is investing heavily in mobile capabilities that will allow complete financial management from any device, anywhere.

Taking the Next Step: Your QuickQore Journey Begins Here

The decision to transform your pizza franchise accounting operations isn’t just about choosing software—it’s about choosing a partner who understands your business, your challenges, and your goals. QuickQore represents more than just a bookkeeping platform; it’s a comprehensive solution designed specifically for the unique needs of pizza franchise owners across America.

Experience QuickQore Risk-Free

QuickQore offers a comprehensive demo that allows you to experience the platform’s capabilities with your actual business data. This isn’t a generic software demonstration – it’s a customized preview of how QuickQore will transform your specific operation.

During your demo, you’ll see:

Real-time invoice processing with your actual vendor data

Automated receipt management using your current expense patterns

Multi-location reporting formatted for your franchisor requirements

Tax calculations specific to your jurisdictions and business model

Accounts receivable and payable workflows tailored to your operations

Join Thousands of Satisfied Pizza Franchise Owners

QuickQore is already transforming operations for pizza franchise owners across the country. From single-location owner-operators to multi-brand franchise groups, QuickQore customers consistently report:

Dramatic time savings on daily bookkeeping tasks

Improved accuracy in financial reporting and tax compliance

Enhanced cash flow management through better accounts payable and accounts receivable processes

Increased profitability through captured discounts and operational efficiencies

Reduced stress from simplified accounting operations

Confident scalability for future growth and expansion

Your Success is Our Success

The QuickQore team is committed to your success. From initial implementation through ongoing support, we’re here to ensure that your experience with the platform exceeds your expectations. Our US-based support team understands the franchise business and is available to help you optimize your workflows, troubleshoot issues, and maximize the value of your QuickQore investment.

Conclusion: The Time for Change is Now

The pizza franchise industry is more competitive than ever, with razor-thin margins and increasing operational complexity. Success requires not just great food and customer service, but also financial management that’s accurate, efficient, and scalable.

Traditional accounting software wasn’t built for the realities of modern pizza franchise operations. The manual processes, disconnected systems, and constant struggle with bookkeeping tasks that should be automated are holding back too many successful operators.

QuickQore represents a fundamental shift in how pizza franchises approach accounting. Built specifically for your industry, designed around your workflows, and focused on your success, QuickQore transforms bookkeeping from a necessary burden into a competitive advantage.

The owners who have already made the switch aren’t just saving time and money—they’re building stronger, more profitable businesses with the confidence that comes from having complete control over their financial operations.

Your pizza franchise deserves accounting software that works as hard as you do. QuickQore is that solution.

Ready to transform your pizza franchise accounting operations? Schedule your personalized QuickQore demo today and discover why thousands of pizza franchise owners across America are making the switch to smarter, more efficient bookkeeping.

Contact QuickQore today to schedule your free demo and see how we can transform your franchise accounting operations.

The Fundamentals: Bookkeeping Essentials Every Pizza Franchise Needs

Bookkeeping is the bedrock of financial accounting for any pizza franchise, providing the structure needed to manage the fast-paced, high-volume world of food service. At its core, effective bookkeeping means having a clear handle on your accounts payable and accounts receivable—knowing exactly what you owe to vendors and what your customers owe you. This clarity is essential for maintaining healthy cash flows and avoiding late payments or missed opportunities for early payment discounts.

A well-designed financial system does more than just keep your books in order; it empowers you to spot trends, catch errors before they become costly, and make informed decisions that drive your business forward. With accurate financial reporting, franchise owners can quickly assess the health of each location, identify areas for cost savings, and ensure compliance with both franchisor and regulatory requirements.

Modern accounting systems, like QuickQore, are purpose-built to streamline these processes. They automate the tracking of every transaction, reduce the risk of manual errors, and provide real-time insights into your financial position. By investing in robust financial systems, pizza franchises can transform bookkeeping from a time-consuming chore into a strategic advantage, freeing up valuable hours and ensuring that every dollar is accounted for.

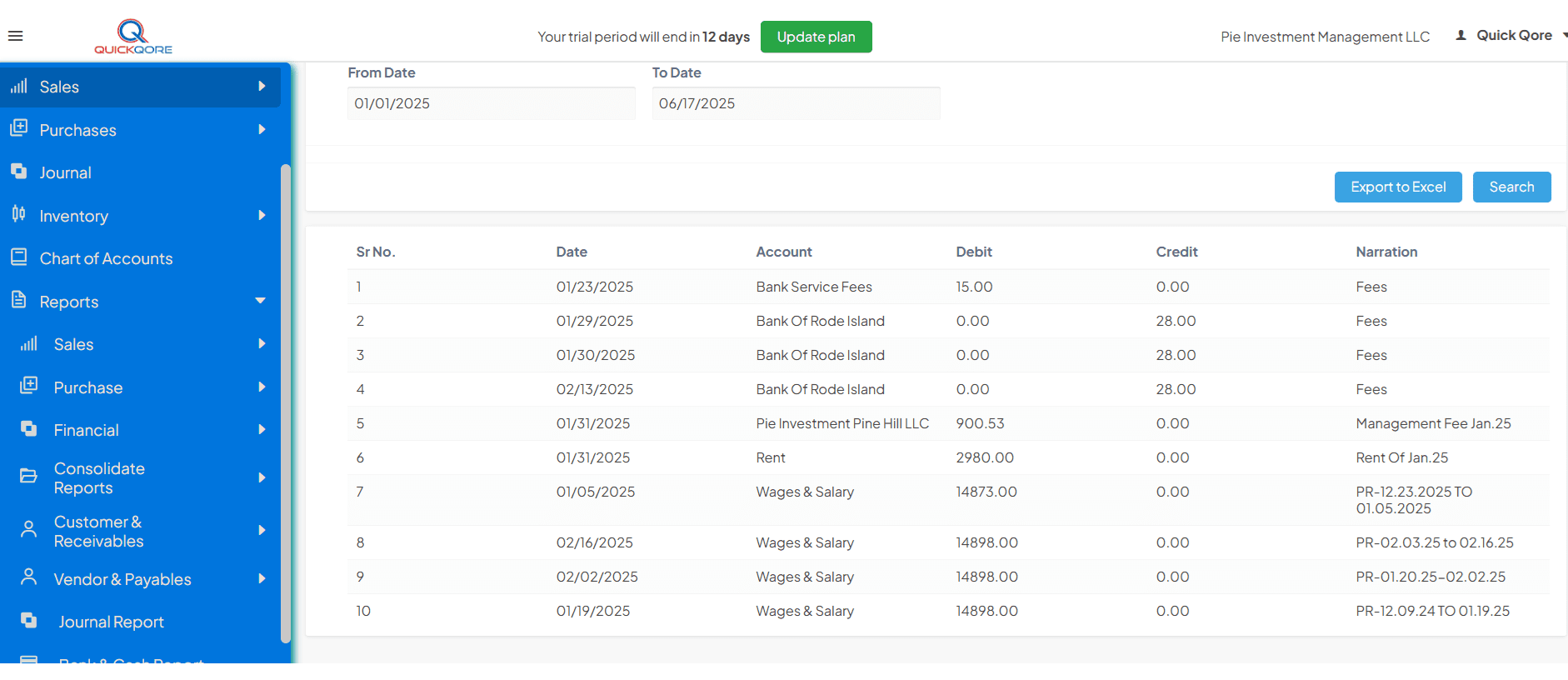

Journal Entries and Record-Keeping: The Backbone of Franchise Accounting

At the heart of every successful pizza franchise’s accounting process lies meticulous record-keeping, anchored by accurate journal entries. Each journal entry serves as a timestamped record of a financial transaction—whether it’s the purchase of raw materials like cheese and flour, the payment of a utility bill, or the receipt of a customer’s payment for a large catering order. These entries are the building blocks that ensure your financial records are complete, compliant, and ready for any audit or tax filing.

Working with a certified public accountant (CPA) can help franchises establish a journal entry system that meets rigorous accounting standards and simplifies the preparation of tax returns. A CPA can guide you on the correct use of credit and debit entries, ensuring that every transaction is recorded accurately and in the right account. This attention to detail is crucial for tracking payments, managing purchases, and maintaining a clear financial history.

Today’s leading accounting software takes much of the guesswork out of journal entry management. Automated systems can record transactions as they happen, flag inconsistencies, and generate reports with just a few clicks. This not only reduces the risk of errors but also streamlines the process of reconciling accounts and preparing for tax season. By prioritizing precise record-keeping and leveraging technology, pizza franchises can maintain financial integrity, support smooth daily operations, and stay ahead of regulatory requirements.

Income Statement Analysis: Turning Numbers into Actionable Insights

For pizza franchises, the income statement is more than just a financial document—it’s a roadmap to smarter business decisions. This essential report summarizes your income, costs, and expenses over a specific period, providing a clear picture of your profitability and cash flow. By regularly analyzing your income statement, you can pinpoint which locations are thriving, which expense accounts are eating into your margins, and where operational improvements can have the biggest impact.

A thorough review of your income statement allows you to break down costs—such as labor, marketing, and raw materials—and compare them to industry benchmarks. You can also assess the value of your asset accounts, like kitchen equipment or delivery vehicles, and determine how these investments contribute to your bottom line. Calculating key metrics, such as cash flow and profit margins, helps you understand the true financial health of your business and make data-driven decisions for future growth.

Modern accounting software makes it easy to generate and analyze income statements, giving you instant access to the financial insights you need. With up-to-date reports at your fingertips, you can quickly identify trends, address issues before they escalate, and ensure that every dollar is working for your business. By turning raw financial data into actionable insights, pizza franchises can optimize operations, control costs, and drive sustained profitability.